Understanding Liability Car Insurance: A Foundation

Every driver who gets behind the wheel faces a sobering reality: accidents happen, and when they do, the financial consequences can be devastating. Liability car insurance serves as your financial shield, protecting you from potentially ruinous costs when you’re at fault in an accident that injures others or damages their property.

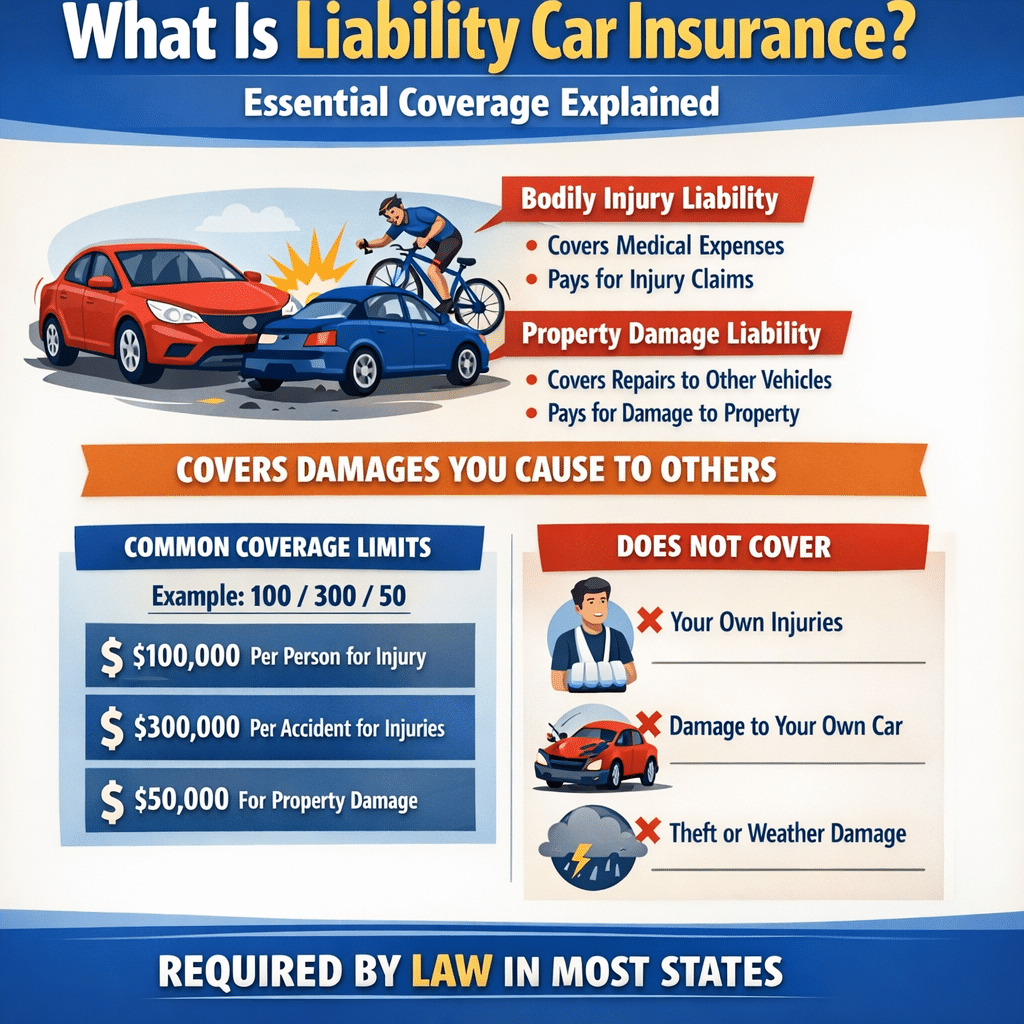

Unlike comprehensive or collision coverage that protects your own vehicle, liability insurance focuses exclusively on the harm you might cause to others. This coverage splits into two essential components: bodily injury liability, which covers medical expenses and related costs for injured parties, and property damage liability, which handles repairs to other vehicles, buildings, or structures you damage.

The financial protection liability insurance provides is staggering in scope. According to industry data, the average bodily injury claim can exceed $20,000, while property damage claims average around $4,700. Without adequate coverage, these costs come directly from your personal assets, potentially including your home, savings, and future earnings. Most states mandate minimum liability coverage levels, recognizing that uninsured drivers create financial hardship for accident victims and burden the healthcare system. However, these state minimums often fall far short of what you’d need in a serious accident, making the choice of coverage limits a critical financial decision that deserves careful consideration.

The Journey to Choosing Liability Car Insurance

Selecting the right auto liability coverage begins long before you step into an insurance agent’s office or visit a company website. The journey typically starts with understanding your state’s minimum requirements, as these vary significantly across the country. For instance, while some states require only $15,000 in bodily injury coverage per person, others mandate $50,000 or more.

Most drivers discover that minimum coverage often falls short of real-world needs. A single accident involving serious injuries can easily generate medical bills exceeding $100,000, making those minimum requirements seem inadequate. Progressive emphasizes that drivers should consider their assets and potential future earnings when determining coverage limits, as these could be at risk in a lawsuit.

The decision-making process also involves weighing cost against protection. Higher liability limits mean higher premiums, but they also provide greater peace of mind. Many financial experts recommend coverage limits that match or exceed your net worth, ensuring that a single accident doesn’t jeopardize your financial future.

Understanding these fundamentals sets the stage for examining the specific components that make up comprehensive liability protection.

Components of Liability Car Insurance

Liability car insurance consists of two fundamental components that work together to protect you financially when you’re at fault in an accident. Understanding these distinct elements helps you make informed decisions about your coverage levels.

Bodily injury liability forms the first component, covering medical expenses, rehabilitation costs, and lost wages for injured parties in the other vehicle or as pedestrians. This protection extends beyond immediate medical bills to include ongoing care, physical therapy, compensation for pain, and suffering. According to AAA, this coverage also handles legal defense costs if you’re sued following an accident. Property damage liability comprises the second component, covering repairs or replacement of the other party’s vehicle, as well as any property you might damage—from guardrails to buildings. State Farm notes that this coverage also includes temporary transportation costs for the other driver while their vehicle is being repaired.

Both components feature coverage limits that determine your maximum financial protection. These limits directly impact your premium costs and your out-of-pocket exposure in severe accidents. The interplay between these components becomes crucial when real-world scenarios test your coverage’s adequacy.

Example Scenarios: Real-World Applications

Understanding how liability insurance works becomes clearer when you examine real-world situations where coverage kicks in. Consider a scenario where you’re backing out of a parking space and accidentally hit another vehicle. Your property damage coverage would handle the repair costs for the other driver’s car, while bodily injury coverage would address any medical expenses if the other driver was injured.

In another common situation, imagine you’re making a left turn and misjudge an oncoming vehicle’s speed, causing a collision. Liability insurance covers the damages you’re legally responsible for, which could include significant medical bills, vehicle repairs, and even lost wages for the other party. Without adequate coverage, these costs would come directly from your personal assets. A more severe example involves a multi-car accident where your vehicle strikes a pedestrian who then falls into traffic. The medical expenses, rehabilitation costs, and potential legal settlements could easily exceed $100,000. This scenario illustrates why many drivers choose limits well above state minimums.

These real-world applications demonstrate that liability insurance isn’t just about minor fender-benders—it’s your financial shield against life-changing lawsuits and expenses. However, what many drivers believe about liability insurance versus what it actually provides can be surprisingly different.

Conventional Wisdom vs. Reality: Liability Insurance’s True Role

Many drivers operate under the misconception that liability coverage is simply a legal checkbox to satisfy state requirements. In reality, this fundamental protection serves as your primary financial shield against potentially devastating lawsuits and claims that could otherwise destroy your financial future.

The conventional wisdom suggests that minimum state requirements provide adequate protection. However, Allstate research indicates that medical costs from serious accidents can easily exceed $100,000, while property damage claims involving luxury vehicles or commercial property can reach six figures or more. Your state’s minimum coverage—often just $25,000 to $50,000—creates a dangerous gap between perception and reality.

Another common misunderstanding involves the scope of liability protection. While many drivers view it narrowly as “covering the other car,” liability insurance actually extends to medical expenses, lost wages, pain and suffering, and even legal defense costs. This comprehensive protection makes liability coverage your most critical insurance decision, not just a regulatory requirement.

Understanding these realities helps explain why insurance professionals consistently recommend coverage limits well above state minimums—and why this foundation deserves careful consideration rather than cursory compliance.

Common Misconceptions and Clarifications

Despite liability insurance being mandatory in most states, several persistent myths continue to confuse drivers about their coverage. One of the most dangerous misconceptions is that liability insurance protects your own vehicle and medical expenses. In reality, liability coverage exclusively pays for damages and injuries you cause to others when you’re responsible for an at fault accident.

Another widespread belief is that minimum state requirements provide adequate protection. While these limits satisfy legal obligations, they often fall short of covering severe accidents. A single hospitalization can easily exceed basic coverage limits, leaving you personally responsible for the difference.

Many drivers also assume their liability coverage follows them to any vehicle they drive. However, liability insurance typically stays with the vehicle, not the driver, making it crucial to verify coverage before borrowing someone else’s car.

Perhaps most critically, some believe that being a “good driver” eliminates the need for robust liability limits. Accidents happen regardless of driving history, and the financial consequences of underinsurance can devastate even the most careful drivers’ financial stability.

Understanding these distinctions helps drivers make informed decisions about their actual protection needs rather than operating under false assumptions.

How Liability Car Insurance Works: A Technical Deep Dive

When an accident occurs, liability insurance operates through a systematic claims process that protects both the policyholder and injured parties. Understanding this technical framework helps clarify why coverage amounts and policy details matter significantly in real-world scenarios.

The claims process begins immediately when an accident is reported. Your insurance company assigns a claims adjuster who investigates the incident, determines fault based on police reports and evidence, and calculates damages. If you’re found liable, your bodily injury coverage pays for medical expenses, lost wages, and pain and suffering for injured parties, while property damage coverage handles vehicle repairs and replacement costs.

A critical but often overlooked aspect involves legal fees and court costs. When lawsuits arise from serious accidents, liability insurance covers your legal defense expenses, which can easily reach tens of thousands of dollars even in straightforward cases. This protection extends beyond the policy limits for damages, meaning your insurer continues paying legal costs even if settlement demands exceed your coverage amounts.

The technical distinction between “per person” and “per occurrence” limits becomes crucial during multi-victim accidents. A single incident involving multiple injuries could quickly exhaust individual coverage limits while still falling within the per-occurrence maximum, demonstrating why understanding these mechanics matters for adequate protection.

Trade-offs and Considerations: Is Liability Insurance Enough?

While liability insurance satisfies legal requirements in most states, many drivers discover its limitations only after an accident occurs. The coverage protects others but leaves significant gaps in your own financial protection that could prove costly.

The most glaring limitation is vehicle damage coverage. If you cause an accident, liability insurance won’t pay for repairs to your own car, potentially leaving you with thousands of dollars in out-of-pocket expenses. For drivers with newer or financed vehicles, this gap can be financially devastating.

Personal injury protection presents another critical consideration. While liability coverage handles others’ medical bills, it doesn’t cover your own injuries or those of your passengers. A serious accident could result in substantial medical expenses that you’ll need to pay personally, even if you have health insurance with high deductibles.

However, minimum liability coverage does offer advantages for budget-conscious drivers. The premiums are significantly lower than comprehensive policies, making car ownership accessible for those with older vehicles or tight financial constraints. For drivers with minimal assets to protect, basic liability coverage might provide adequate protection against lawsuits.

The key question becomes whether the savings justify the risk exposure—a calculation that depends heavily on your financial situation and driving circumstances.

Key Takeaways

Liability car insurance serves as your financial shield against the potentially devastating costs of injuring others or damaging their property in an accident. While coverage requirements vary by state, the fundamental principle remains consistent: protecting both you and other drivers from financial ruin.

The two core components—bodily injury and property damage liability—work together to handle different aspects of accident costs. Bodily injury coverage addresses medical expenses, lost wages, and pain and suffering for injured parties, while property damage coverage handles vehicle repairs, replacement costs, and damaged infrastructure like guardrails or buildings.

State minimum requirements represent the legal floor, not necessarily adequate protection. Many financial experts recommend coverage levels significantly higher than state minimums, particularly given that average claim costs continue rising annually. A single serious accident involving multiple vehicles or severe injuries can easily exceed basic coverage limits.

However, liability insurance has clear limitations—it won’t cover your own vehicle damage, medical expenses, or losses from uninsured drivers. Understanding these gaps helps determine whether additional coverage types like collision, comprehensive, and or uninsured motorist protection make sense for your situation. The key is balancing legal compliance, financial protection, and budget constraints while recognizing that adequate coverage varies based on your assets, driving patterns, and risk tolerance. For comprehensive guidance on selecting appropriate coverage levels and understanding your options, reliable resources can help you make informed decisions.

Where to Look Next for Reliable Information

Understanding liability car insurance is just the beginning of making informed decisions about your auto coverage. As you move forward, several trusted resources can help you navigate the complexities of insurance policies and find the right protection for your specific situation.

Major insurance companies provide comprehensive educational resources alongside their quote tools. Liberty Mutual’s educational content breaks down complex insurance concepts into digestible explanations, helping you understand exactly what you’re purchasing before you buy.

Your state insurance department serves as an invaluable resource for understanding local requirements and consumer protections. These departments maintain databases of licensed insurers, complaint records, and state-specific coverage mandates that can influence your coverage decisions.

Independent insurance agents offer personalized guidance without being tied to a single company’s products. They can compare multiple carriers simultaneously and explain how different policy features might benefit your particular circumstances.

Remember that liability insurance represents your foundation, not your ceiling. As you explore your options, consider how comprehensive coverage, collision protection, and additional endorsements might complement your basic liability protection. The goal isn’t just meeting minimum requirements—it’s creating a safety net that protects your financial future while keeping you legally compliant on the road.frase.io