What Is Temporary Motorcycle Insurance?

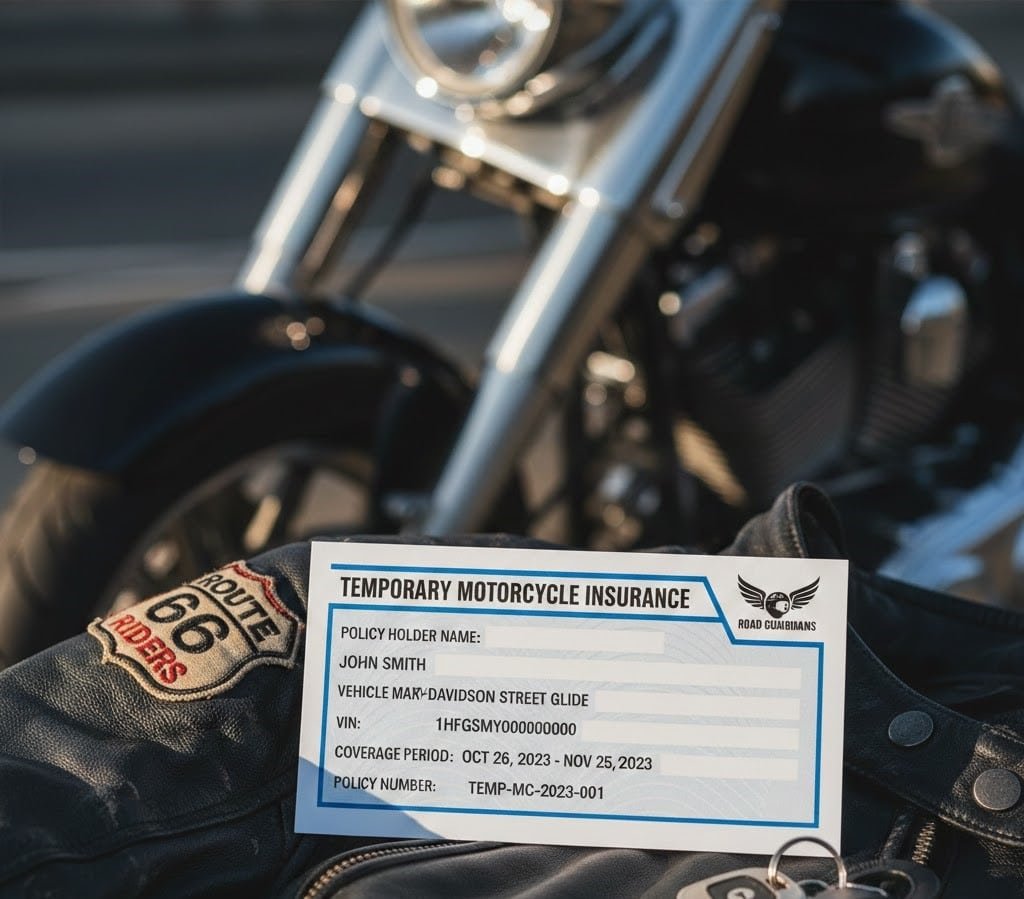

Temporary motorcycle insurance is a short-term policy designed for specific, limited periods. Typically, it ranges from 1 day to 6 months, depending on state regulations and insurer policies.

It is perfect for:

- Seasonal riders

- Test rides or temporary ownership

- Short-term rentals

Temporary insurance provides legal protection and basic coverage without committing to an annual policy.

Why Temporary Motorcycle Insurance Is Important

Some riders skip insurance assuming short-term use won’t matter. This is a mistake:

- Accidents can happen on day one

- Medical bills and legal fees are high in 2026

- Riding uninsured risks fines, license suspension, and lawsuits

Even if you plan to sell or park the bike soon, temporary insurance reduces financial exposure.

Types of Temporary Motorcycle Insurance Coverage

1. Liability Coverage (Mandatory)

Covers:

- Bodily injury to others

- Property damage

Does not cover your motorcycle or medical bills. Most states legally require at least liability coverage for temporary riders.

2. Optional Coverages

- Collision Coverage: Repairs for your motorcycle after an accident

- Comprehensive Coverage: Theft, fire, vandalism, and weather damage

- Medical / Personal Injury Protection: Covers medical bills for you and passengers

Optional coverage is often available for temporary policies but may increase the short-term premium slightly.

Who Needs Temporary Motorcycle Insurance?

- Seasonal riders – Riding only a few months per year

- Test drivers – Evaluating a new or used motorcycle before purchase

- Short-term ownership – Borrowed or rented motorcycles

- Special events – Track days or temporary road usage

It is not a substitute for full annual coverage if you ride year-round.

Cost Factors for Temporary Motorcycle Insurance

Temporary insurance costs are generally pro-rated based on duration, bike type, and coverage selected. Key factors include:

- Duration of coverage – Shorter periods cost less overall, higher daily rates

- Bike type – High-powered motorcycles are more expensive

- Rider history – Accidents or violations can increase premiums

- Coverage limits – Higher liability and optional coverages increase cost

- Location – Urban areas with higher accident rates can cost more

Typical cost: $15–$50 per day depending on bike, coverage, and state.

Temporary vs Annual Motorcycle Insurance

| Feature | Temporary Insurance | Annual Insurance |

|---|---|---|

| Duration | 1 day – 6 months | 12 months |

| Cost | Lower total | Higher total, lower per-day cost |

| Coverage | Liability + optional | Full coverage options |

| Use Case | Seasonal, short-term | Daily commuting or year-round use |

| Flexibility | High | Fixed term |

Temporary policies are a smart, flexible solution for short-term riders, but not ideal for daily commuting.

Liability Motor Insurance in Temporary Policies

Even temporary insurance relies on liability motor insurance as the foundation:

- Protects third parties if you’re at fault

- Meets state legal requirements

- Reduces exposure to lawsuits or fines

It ensures you are always covered, even for short-term riding periods.

Affordable Temporary Motorcycle Insurance Tips

- Compare multiple providers online for short-term quotes

- Check coverage limits carefully; state minimums may be too low

- Bundle with auto or other bike insurance if possible

- Maintain a clean driving/riding record for lower premiums

Temporary insurance is not about price alone. Coverage adequacy is critical.

Marketing Funnel Logic

- Awareness: What is temporary motorcycle insurance?

- Consideration: Short-term coverage options, cost, and risk

- Decision: Comparison, recommended coverage, brand trust

This page covers all three stages, converting casual readers into leads.

Comparison Table: Temporary vs Standard Policies

| Policy Type | Duration | Cost | Coverage | Risk |

|---|---|---|---|---|

| Temporary Liability | 1–30 days | Low | Minimal | Medium |

| Temporary Full Coverage | 1–30 days | Medium | Strong | Low |

| Annual Liability | 12 months | Medium | Moderate | Medium |

| Annual Full Coverage | 12 months | Higher | Maximum | Minimal |

Choosing coverage based on risk exposure, not cost, is the key to smart insurance decisions.

FAQ Schema (PAA-Focused)

Q1: What is temporary motorcycle insurance?

Short-term coverage for limited periods, usually 1 day to 6 months, covering liability and optional protections.

Q2: Who should get temporary motorcycle insurance?

Seasonal riders, test riders, rentals, and short-term owners.

Q3: Does temporary insurance cover theft?

Yes, if you add comprehensive coverage to the temporary policy.

Q4: How much does temporary motorcycle insurance cost?

Typically $15–$50 per day depending on bike, coverage, and state.

Q5: Can temporary insurance satisfy state legal requirements?

Yes, liability coverage meets minimum state requirements.

Pingback: Bike Insurance in USA: Coverage, Cost & Options 2026 - Liability Motor Insurance